Business Insurance in and around Saint Louis

One of Saint Louis’s top choices for small business insurance.

Helping insure small businesses since 1935

Business Insurance At A Great Value!

Small business owners like you have a lot of responsibility. From inventory manager to tech support, you do everything you can each day to make your business a success. Are you a real estate agent, an insurance agent or a plumber? Do you own an auto parts shop, a beauty salon or a travel agency? Whatever you do, State Farm may have small business insurance to cover it.

One of Saint Louis’s top choices for small business insurance.

Helping insure small businesses since 1935

Strictly Business With State Farm

When one is as passionate about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for business owners policies, worker’s compensation, surety and fidelity bonds, and more.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Jeremy Mast's office today to identify your options and get started!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

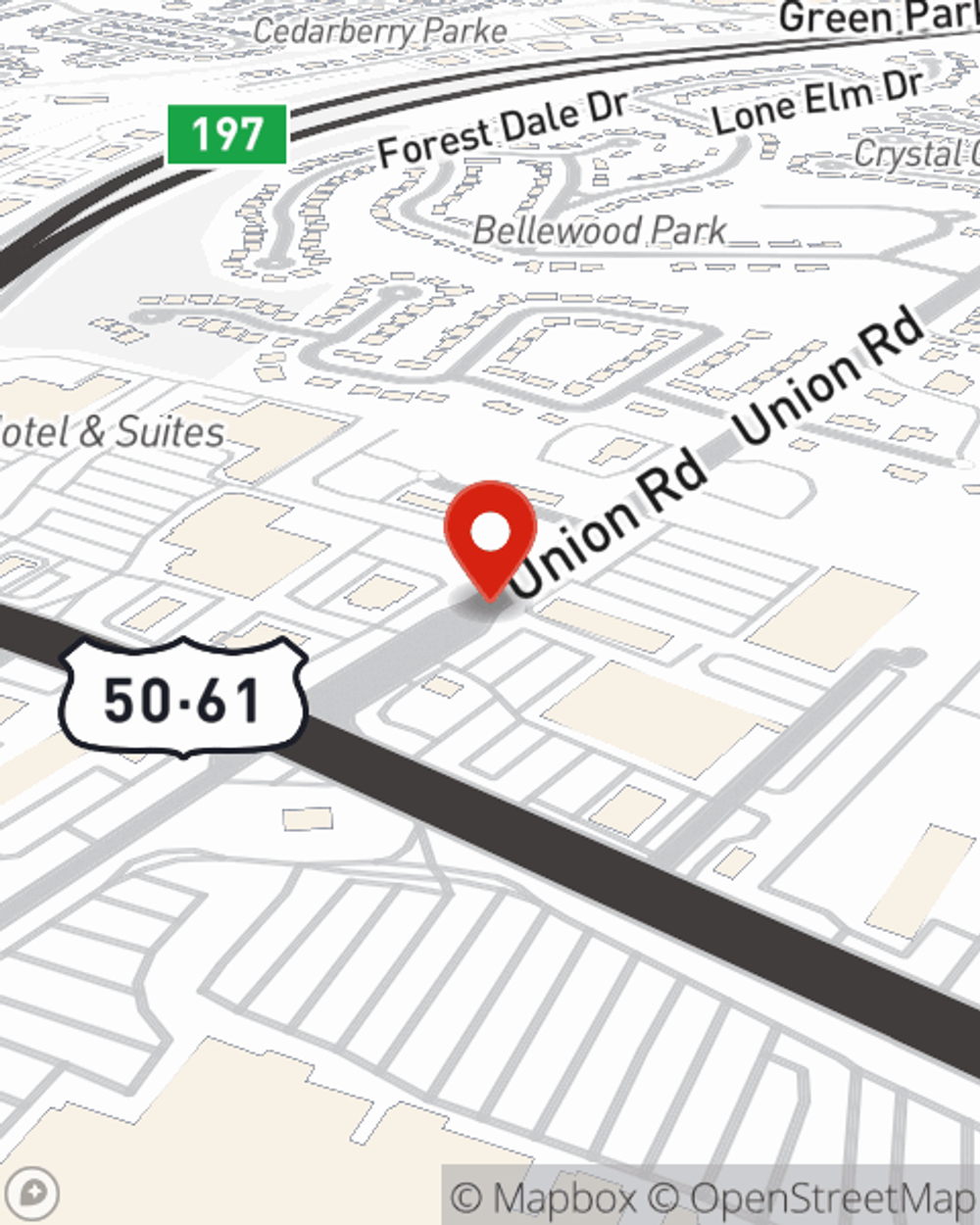

Jeremy Mast

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.